“Antivirus Programme” – Category A and B extended and Category C accepted - UPDATE June 2020

Category A and B have now been extended until the end of August 2020 and the government has approved a new form of support – Category C!

Are you considering how to maintain employment of your employees and minimize economic losses? Take a look at what financial instruments the state has prepared for entrepreneurs whose employees have been affected, directly or indirectly, by government measures taken to combat coronavirus. Category A and B have been extended until the end of August 2020. On 16 June 2020 the parliament approved a new form of support – Category C in its original wording according to the government’s proposal. The amendment proposal was not accepted and Category C has now been signed by the Czech president and is waiting to be published in the Collection of Laws.

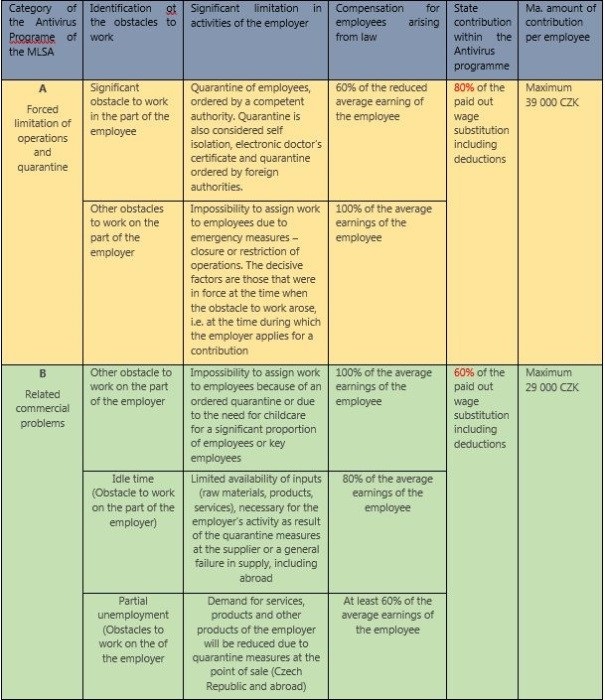

Under the Antivirus program, the Ministry of Labour and Social Affairs (MLSA) has prepared several types of compensation for employers, depending on the different situations in which they may find themselves. According to published statistics as at 27 May 2020, during March and April 2020 an amount of CZK 799,165 was paid out in contributions out of a total amount of CZK 7,413,422,411.

Below we set forth answers to the most frequently asked questions in this matter.

Where and how do I apply?

Only by electronic means, via the website application at https://antivirus.mpsv.cz or by using electronic data mailboxes or email with an acknowledged electronic signature.

How should I proceed as an employer?

1. The employer shall first fill in the application for the allowance for compensation of wages, on the basis of which an agreement on the provision of the allowance will be automatically generated between the Labour Office and the employer. Attached to the application for the allowance is a document on the establishment of the employer's account, to which the Labour Office will then send reimbursements of wages paid and, if applicable, a power of attorney for the employer's representative.

2. The employer shall then send the application together with the agreement and attachments via a data box or e-mail with a recognized electronic signature. The agreement thus sent shall be deemed to have been signed by the applicant. Subsequently, it will be checked whether the agreement can be concluded, in other words, whether the agreement is without defects and the employer preliminarily meets the conditions of the Antivirus program. The agreement is concluded if it is electronically signed by the Labour Office and sent back to the employer (data box or e-mail with a recognized electronic signature).

3. After the conclusion of an agreement between the Labour Office and the employer, the employer must submit a monthly statement of paid wage compensations, including mandatory contributions. You will need to do this for each Antivirus Category separately and for each month. Even in this case, the bill is sent via a data box or e-mail with an electronically verified signature.

When will I receive state contributions as an employer?

After sending the statement and checking whether the employees to whom the right to the claim is claimed are the employees of the employer and the contribution can be applied for, the contribution will be provided to the specified account of the employer.

For what period can I apply for a contribution?

For the period from 12 March 2020 to 31 August 2020. The employer is entitled to claim compensation for compensation of wages paid to employees for a maximum of two calendar months immediately preceding the month in which the agreement was concluded. Both categories A and B have been extended until the end of August 2020.

Can I claim for all my employees?

It will always depend on why the employee does not work - that is, the reason for his obstacle at work. Even if the employee is at home for one of the reasons listed below, the allowance can only be claimed for an employee ("employment contract") - the employee must not be on notice as of the date of submission of the payroll statement, he must not be dismissed (does not apply in the case of termination pursuant to section 52 letter g) or h) of the Labour Code) and must participate in sickness and pension insurance. At the same time, it is necessary for the employer to first pay the employee's salary and pay the mandatory contributions. Also, it is not possible to apply for a contribution if the employer has already received another contribution for the employee from the Labour Office. The employer's contribution is not due even if the wage compensation is covered by other public budgets. Compensation cannot also be provided if the employee is also a company executive or a member of the employer's statutory body, if the employment contract was signed by the same natural person on the part of both the employer and the employee.

Is there any other form of support for employers?

Yes, the MLSA has prepared another form of targeted support for employers in order to protect employment, referred to as "Category C"; the relevant law was signed by the Czech President on 19 June 2020 and is awaiting publication in the collection of laws. Scheme C consists of a waiver of social security contributions and contributions to the state employment policy paid by the employer for employees in the months of June to August 2020. However, this form of support is to be granted only to smaller employers whose number of employees participating in health insurance, does not exceed 50 on the last day of the calendar month. An employer will also have to maintain 90% employment and 90% of the employees' assessment bases for entitlement to support under Category C compared to March 2020. Entitlement to support under Category C will not arise for employers who already draw a contribution from the Antivirus program in the relevant calendar month to compensate paid wages. The proposal approved by the government will now be discussed by the Chamber of Deputies and the Senate.

To be eligible for Category C support, the employer will also have to maintain a certain employment rate and share of employees' assessment bases compared to March 2020. The condition is therefore that the number of employees at the end of the relevant month for which the employer applies waivers state employment policy must be at least 90% compared to the end of March 2020. The maximum allowable decrease Also in the total assessment bases of employees (volume of wages) is proposed by the Senate to reduce from the proposed by the government may not fall below 90% to 80% compared to the end of March 2020. Here, too, the Senate's amendments were not adopted, which increased the permitted decrease to 80% and at the same time specified that this was the average recalculated number of employees, ie not the physical number of employed persons.

What to look out for when determining entitlement to a Social Insurance waiver under Category C?

An employer who already draws a contribution from the Antivirus program to compensate the paid wage compensation in the relevant calendar month is not entitled to support under Category C. Furthermore, the decrease in the number of employees should not include, among others, people who have resigned themselves or retired. Employers who were not tax residents of the Czech Republic or any of the EU or EEA Member States as of 1 June 2020 and did not achieve the majority of their income from sources in the Czech Republic are also not entitled. The law also contains certain limits regarding the amount of forgiven insurance premiums in relation to employee remuneration exceeding certain multiples of the average wage.

Please note that the waiver of insurance premiums only applies to employees.

Therefore, it cannot be applied in the case of employees who work for the employer for agreements on the performance of work or work activities, even if, as a result of the amount of remuneration (higher than CZK 3,000 or CZK 10,000), the employer would be obliged to pay for these employees. pay premiums. Similarly, this support cannot be applied in the case of an agent, although his remuneration is taxed and subject to insurance premiums in the same way as for employees (however, if the agent has a valid employment contract in addition to the contract, he may qualify under this employment contract). These persons will also not be included in the above-mentioned criteria determining the origin of the employer's entitlement, as they are not employees.

Furthermore, it is necessary to pay attention to situations where the employee remains in employment, but is not covered by health insurance, especially for the purposes of calculating the maximum possible decrease in employees by 10%. This may be a situation where the employee starts drawing maternity maternity allowance or parental leave allowance, his absence due to illness exceeds 14 days, takes unpaid leave or benefits when caring for a family member and so on. Such employees cannot be counted for the purpose of meeting the above criteria, which may, especially for smaller companies, jeopardize the fulfilment of the above-mentioned condition of maintaining at least 90% of the number of employees compared to the end of March 2020.

So what support am I entitled to in Category A and B?

How do I need to proceed?

It is advisable to start by compiling an overview of employees and their hours worked by place of operations , specifying on which days employees worked and which days they did not, and for what reason. We also recommend adding the amount of wage compensation provided. For employees who potentially meet the requirements, it is recommended to indicate under which compensation scheme they would fall and calculate the amount of compensation provided by the employer and compare this with the maximum contribution that the state should provide.

How to pay advances for income tax on employment and contributions to insurance?

When paying wage compensation to employees in the above cases, it is important to distinguish what constitutes a limitation in the employer's activity. In the case of an A-category wage reimbursement where the employee has been ordered to quarantine, the employer pays the wage reimbursement to the employee for up to 14 calendar days according to the above information. Then the wage compensation is paid by the Czech Social Security Administration. However, this compensation paid by the employer is specific because it is exempt from income tax on employment and is not subject to insurance contributions. The other remuneration referred to above is paid by the employer to the employee as long as the obstacle to employment persists and is subject to both income tax and dependent contributions. Therefore, mandatory deductions should be considered in these cases. From the employer's point of view, the compensation of wage substitution and possible contributions provided to employers is tax neutral.

The right to a premium waiver in Category C will be claimed by the employer on the form "Summary of the amount of the premium". For the months for which the premium is waived, the form will be supplemented by a reduced assessment base. The form is sent to the District Social Security Administration (OSSZ) only electronically. The employer himself assesses whether he meets the conditions for entitlement to a waiver of insurance premiums and calculates the amount of insurance premiums that he will be obliged to pay. The waiver of insurance premiums will therefore take place by reducing the employer's assessment base. The employer will then check the employer's progress within the framework of regular follow-up inspections.