„Antivirus Programme“ – an instrument of financial assistance for employers UPDATE01

Are you considering how to maintain employment of your employees and minimize economic losses? Take a look at what financial instruments the state has prepared for entrepreneurs whose employees have been affected, directly or indirectly, by government measures taken to combat coronavirus.

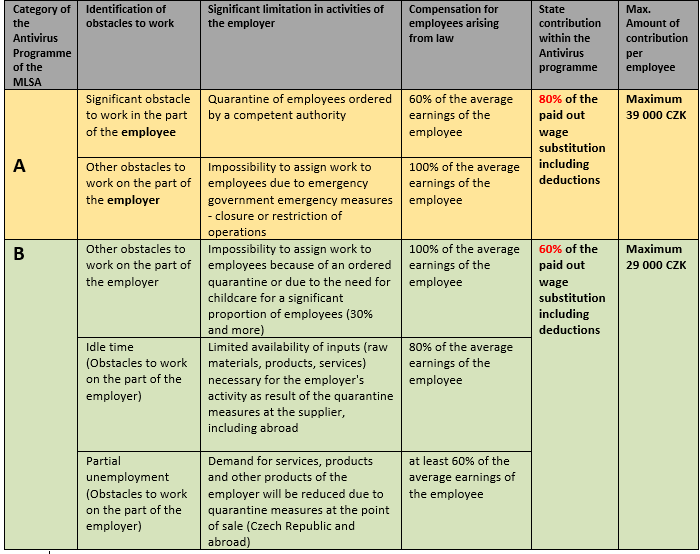

Under the Antivirus program, the Ministry of Labour and Social Affairs (MLSA) has prepared several types of compensation for employers, depending on the different situations in which they may be located. Details of how to apply for compensation or how government authorities will assess compliance with the conditions for payment of compensation should be known later this week.

When can I apply?

from 6 April 2020

Where and how do I apply?

At the Labour Office - electronically

For what period can I apply? In the first phase, for compensation paid to employees in March 2020, according to the duration of the obstacles to work below.

Can I claim a contribution for all my employees?

It will always depend on why the employee is not working – i.e., what is the reason for his / her obstacle to work. Even if the employee is at home for any of the reasons given below, the contribution can only be claimed for an employee ("on contract") - the employee must not be in the notice period, must not be dismissed and must participate in sickness and pension insurance. At the same time, it is necessary for the employer to pay the employee's salary first and make the mandatory deductions.

Consider therefore, your situation and which of the cases below apply to your business:

The Ministry of Labour and Social Affairs was mandated by the Government to further prepare a compensation program for entrepreneurs who continue to operate but whose production has decreased due to measures (category C of the Antivirus Programme).

How do I need to proceed?

It is advisable to start by compiling an overview of employees and their hours worked by place of operations , specifying on which days employees worked and which days they did not, and for what reason. We also recommend adding the amount of wage compensation provided. For employees who potentially meet the requirements, it is recommended to indicate under which compensation scheme they would fall and calculate the amount of compensation provided by the employer and compare this with the maximum contribution that the state should provide.

How to pay advances for income tax on employment and contributions to insurance?

When paying wage compensation to employees in the above cases, it is important to distinguish what constitutes a limitation in the employer's activity. In the case of an A-category wage reimbursement where the employee has been ordered to quarantine, the employer pays the wage reimbursement to the employee for up to 14 calendar days according to the above information. Then the wage compensation is paid by the Czech Social Security Administration. However, this compensation paid by the employer is specific because it is exempt from income tax on employment and is not subject to insurance contributions. The other remuneration referred to above is paid by the employer to the employee as long as the obstacle to employment persists and is subject to both income tax and dependent contributions. Therefore, mandatory deductions should be considered in these cases. From the employer's point of view, the compensation of wage substitution and possible contributions provided to employers is tax neutral.